Navigating the Reality of Long-Term Care Expenses While Securing Your Retirement

Written by: Terry Westlund, CHFC®

We can all grasp the importance of having a solid retirement savings built up, but what happens if you face health challenges during your golden years?

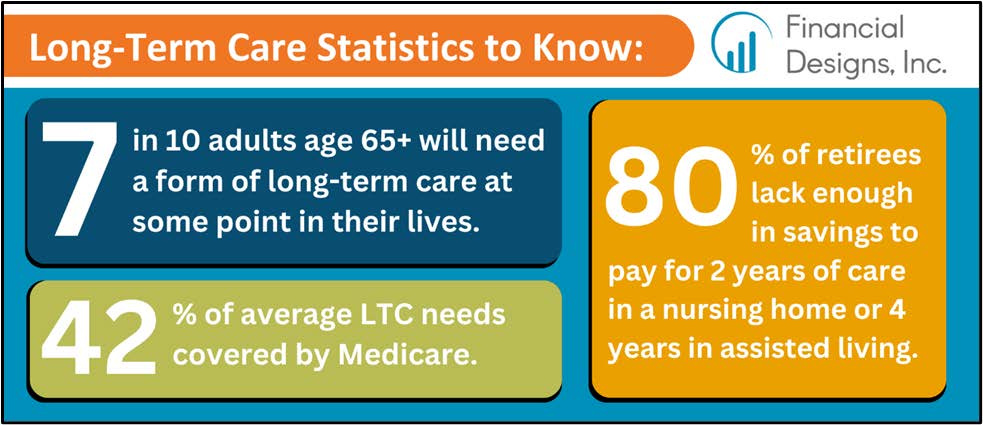

These statistics are only going to grow as an aging American population continues to drive an increase in demand for elder care services. With all of this in mind, we should review the basics on long-term care and then we can explore a few ways to secure your retirement and plan for these likely-necessary expenses.

Understanding What “Long-Term Care” Really Means

The term basically encompasses services and support that individuals will likely require to meet their personal care needs due to age, disability, or medical causes. These services can include assistance with things like eating, bathing, using the toilet, dressing, housework, managing money, dispensing medication, preparing meals, shopping for groceries, transportation, caring for pets, and more.

Who Pays for It? Won’t Medicare Pick Up the Bill?

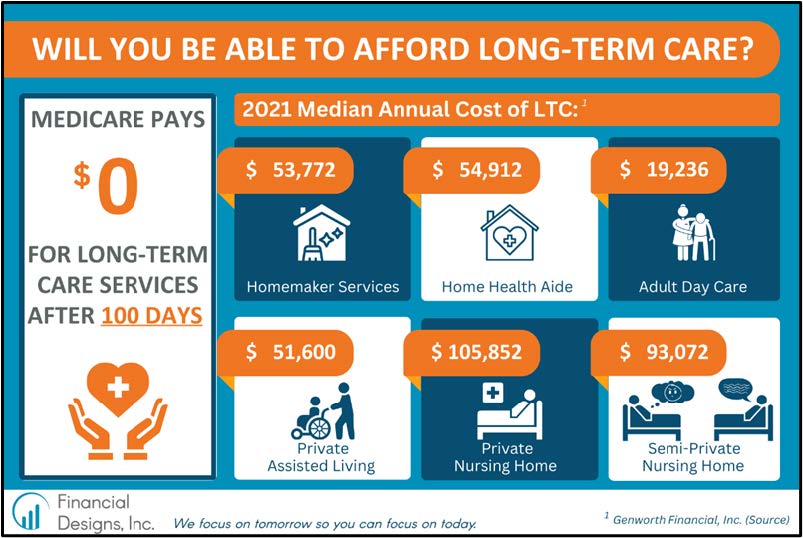

In short, no. Contrary to common belief, Medicare doesn’t fully cover long-term care expenses. While it may cover skilled care for up to 100 days in certain cases, ongoing costs are your responsibility, so it’s crucial to understand what to expect when using these services.

Medicaid

Medicaid can also pick up some of the costs associated with obtaining long-term care after a patient’s assets are significantly depleted, but this will mean you will have significantly fewer choices in which facilities and services you use.

This is why many individuals consider purchasing long-term care insurance. Think of it as “disability insurance for seniors”. Just as you can secure this coverage during your working years to protect your income in case of injury or illness, LTC coverage safeguards your assets during retirement.

What Types of LTC are Available to Me?

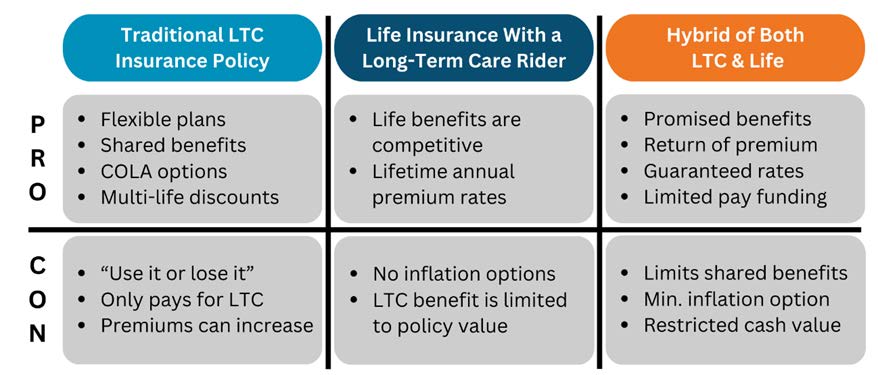

Long-term care coverage has evolved over the years, with alternative strategies emerging more recently. Traditionally, you could purchase coverage that followed a “use it or lose it” approach. Now, there are options to combine life insurance with LTC coverage, a choice preferred by many of our clients over the traditional route. These options also allow you to pay a lump sum up-front or make payments over a specified period. Explore the pros and cons of these various options in more detail below:

How Can I Figure Out Which Option is Right for Me?

Work with your financial advisor and more importantly, ensure you understand the benefit amount and duration of coverage. Also consider things like your options for cost-of-living increases, the ability to share benefits with a spouse, and whether the rates remain guaranteed over time (meaning no cost increases).

Shop for the best deal on coverage too! Your financial advisor can give you information on discounts available to you which are often linked to good health and couple/partner policies.

Okay, When Should I Start Preparing for My LTC Needs?

At Financial Designs, we recommend starting to contribute toward long-term care funding sometime in your 40s which adds another layer of protection to your assets from depletion. Whether you opt for a policy or self-funding, it’s vital to have a well-thought-out plan and share it with your family members which will help alleviate a lot of the anxiety associated with arranging this type of care if and when the time comes.

Financial professionals may only conduct business with residents of the states or jurisdictions in which they are properly registered, licensed or exempt from registration, and not all of the securities, products, and services mentioned are available in every state or jurisdiction.

Advisory services available in all 50 states upon request.

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, Financial Designs, Inc. makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to, or your use of third-party technologies, sites, information and programs made available through this site.

Financial Designs, Inc.

11225 College Blvd., Suite 300

Overland Park, KS 66210

Toll free: 888-898-3627 (voice call only)

Local: 913-451-4747 (voice call only)

Fax: 913-451-8191

Contact us today