By Cathy Lucas, Guest Writer, IDShield

By Cathy Lucas, Guest Writer, IDShield

If someone stole your identity, would you know it?

Identity theft can be a serious problem resulting in 100+ hours of work to resolve the issue. Thieves are getting more and more complex in how they obtain your personal data, reaching far beyond just financial information. How well are you protecting your identity? See the following facts and tips on how to keep you and your family’s personal information out of the hands of thieves.

What kinds of information is being stolen and how is it being used?

Gone are the days when your only worry is about your credit or debit card being compromised. In fact, this is the easiest kind of identity theft to correct as banks and credit card companies are now required to have a third-party company to monitor transactions.

Thieves have found there are many other data points that are worth much more than a credit card number. For example, social security numbers are highly valuable. When illegal immigrants come to the United States they need a SSN and an ID. Where do they get that? From our stolen information. This can go undetected for years… imagine getting a notice from the IRS that you owe taxes for a job you never worked in another state. Or that an officer puts you in handcuffs for a rolling stop because there is a warrant out for your arrest for something you didn’t do.

Medical information is also a popular data point that is stolen as it contains everything about us. On the black market, medical information for one individual can be worth $1,100. If enough information is stolen, someone else may be able to use our medical benefits to get services or drugs they need. This is a huge issue because if medical records are then altered (i.e. your blood type), this could have massive consequences in an emergency.

Other information that is commonly stolen includes driver’s licenses, passports and Medicare cards. Take note that none of this stolen information would be found by monitoring your credit only.

How does my data get stolen, and how do I know when that happens?

Your data can be stolen in a variety of ways including thieves going through your trash, stealing your wallet, stealing your mail (or submitting a change of address for you), using fake emails to get you to provide personal information or hacking your computer. Warning signs include:

– Mistakes on accounts or your Explanation of Benefits

– Regular bills go missing

– Calls from debt collectors for debt that is not yours

– Notice from the IRS

– Calls or emails about accounts in your minor child’s name

How do I keep my information safe?

Here are some tips that may seem straightforward but that are more important than ever:

– Read your bank/credit card statements and Explanation of Benefits. Follow-up if you see something you don’t expect.

– Check your credit report from all 3 bureaus (TransUnion, Experian, Equifax). You can only pull your report once per year per bureau – choose a bureau every 4 months to spread it out.

– Shred financial documents and other sensitive documents.

– Be diligent on who you give your SSN to – why do they need it? Do they need it right now?

– Never respond to emails asking for personal information.

– Protect your computer – use antivirus software, encrypt your data, use your home WIFI, lock your computer.

– Don’t use your cell phone to store personal information.

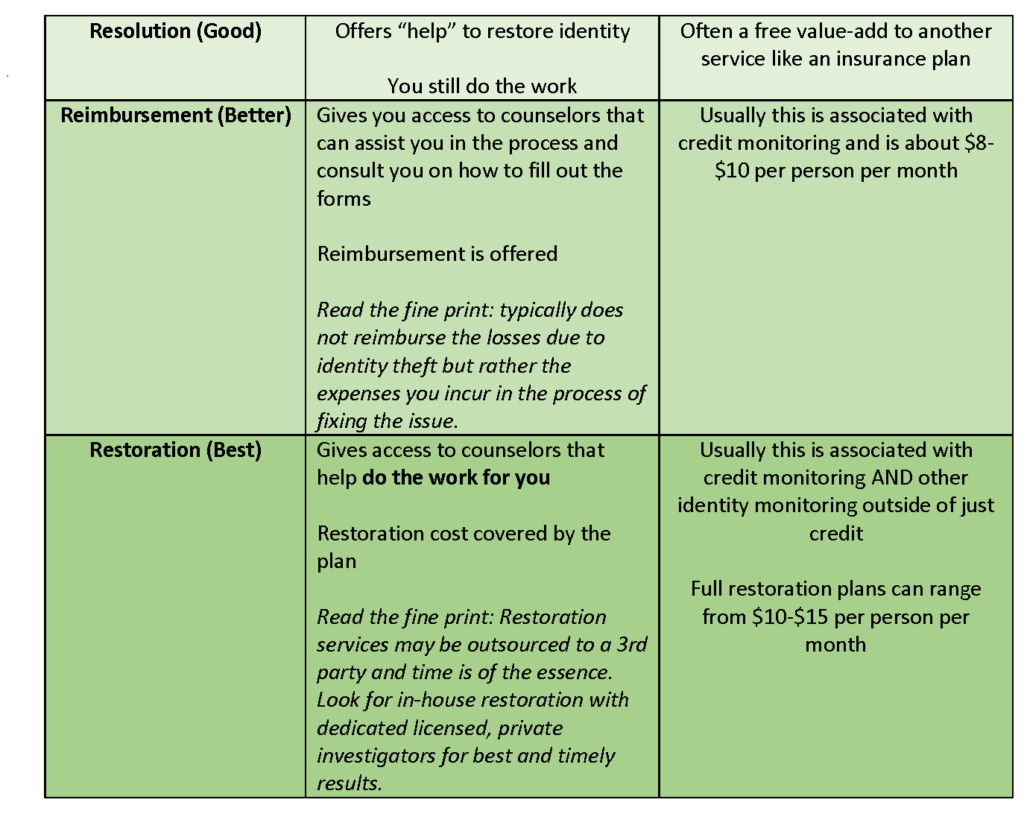

Lastly, consider enrolling in a service that helps you proactively monitor your identity including things like an address change request, court record monitoring, credit inquiries, payday loan monitoring, use of your SSN, DOB or DL on the dark web, etc. Ideally, this is also a service that will RESTORE your identity for you if an incident occurs. What do we mean by restore? Restoration is the highest level of service offered by the various monitoring companies. See below for the typical options found in today’s marketplace:

Let’s go back to our original question – If someone stole your identity, would you know it? Whether you use a partner like IDShield or another organization, it is imperative you monitor the use of your identity for both you and your family members. Unfortunately, this is a new “normal” and just as you protect yourself in a dark parking lot, you must protect your identity on the web. We are passionate about keeping you and your family protected here at Financial Designs. Reach-out to us if you would like to be connected with IDShield to learn more information about their Identity Monitoring & Restoration service. Just as our parents taught us when were young, remember, safety first.

This communication is strictly intended for individuals residing in the sates of AL, AR, AZ, CA, CO, CT, FL, GA, IL, IN, KS, KY, LA, MI, MN, MO, NC, NJ, NY, OH, OK, OR, PA, SC, TN, TX, UT, VA, and WA. No offers may be made or accepted from any resident outside the specific states referenced.

Advisory services available in all 50 states upon request.

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, Financial Designs, Inc. makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to, or your use of third-party technologies, sites, information and programs made available through this site.

Financial Designs, Inc.

11225 College Blvd., Suite 300

Overland Park, KS 66210

Toll free: 888-898-3627 (voice call only)

Local: 913-451-4747 (voice call only)

Fax: 913-451-8191

Contact us today